Law Society switch brokers on dodgy insurance scheme. AN INSURANCE scheme operated by the Law Society of Scotland – which covers all Scottish solicitors – and is designed to ‘protect’ consumers when lawyers walk off with their cash and other assets – has announced a change of brokers from Marsh to Lockton.

Law Society switch brokers on dodgy insurance scheme. AN INSURANCE scheme operated by the Law Society of Scotland – which covers all Scottish solicitors – and is designed to ‘protect’ consumers when lawyers walk off with their cash and other assets – has announced a change of brokers from Marsh to Lockton.

The switch was announced last week by the Law Society – who said brokers Lockton will administer and broker the Master Policy of Professional Indemnity Insurance from 1 January 2017.

The move comes after Marsh – who managed the policy for nearly 40 years – lost the five yearly tender process in April 2016 to Lockton.

The Master Insurance Policy is a compulsory Professional Indemnity Insurance arrangement enforced by the Law Society upon all solicitors in Scotland.

The scheme includes all in-house solicitors who work for the Scottish Government and lawyers from the Government Legal Service for Scotland (GLSS) seconded around public bodies and other branches of the Executive such as the Scottish Parliament and justice bodies.

The Master Policy claims to provide cover of up to £2 million for any one claim where the solicitor is ‘established’ to have been negligent.

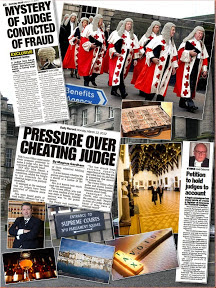

However, the process of establishing whether a solicitor is negligent or not – is controlled by the legal profession and the courts.

In a statement issued by the Law Society, Chief Executive Lorna Jack claimed “The Master Policy provides an important protection for solicitors’ clients when things go wrong. The insurance means that any valid claim against a Scottish solicitor will be paid – even if the solicitor is no longer in practice, no longer solvent or cannot be traced.”

However, the claims – echoed from Jack’s predecessor – Douglas Mill – were previously & spectacularly taken apart by Deputy First Minister & Finance Secretary John Swinney, during a Scottish Parliament investigation into self regulation of the legal profession in 2006.

Mr Swinney branded the Law Society & Master Policy as manipulative after Mill claimed the Law Society kept a distance from the client compensation insurance arrangements.

Mr Swinney produced an internal memo from Mill himself – who had requested a “summit meeting how to dispose of several valid claims.”

Mill went onto “swear on his granny’s grave” he and the Law Society had never intervened in a compensation claim.

However, the memo – produced by Swinney during the Holyrood hearing – came to illustrate the significant level of dishonesty and manipulation with regard to the ‘consumer protection policy’ – which despite Mill’s claims to the contrary – rarely pays full compensation after lawyers swipe clients assets.

The Master Policy was more recently linked in a Research Report to deaths and suicides of clients who attempted to claim back hundreds of thousands of pounds taken by legal agents engaged in corrupt practices not covered by an alternative Scottish Solicitors Guarantee Fund run by the legal profession.

The independent report, compiled by legal academics Professor Frank Stephen & Dr Angela Melville from the University of Manchester School of Law – concluded the Master Policy “is simply designed to allow lawyers to sleep at night.” rather than protect consumers from rogue elements within the legal profession.

According to the report “claimants described being intimidated, being forced to settle rather than try to run a hearing without legal support, and all felt that their claims’ outcomes were not fair. Some claimants felt that they should have received more support, and that this lack was further evidence of actors within the legal system being “against” Master Policy claimants. Judges were described as being “former solicitors”, members of the Law Society – and thus, against claimants. Some described judges and other judicial officers as being very hostile to party litigants.”

Cases referred to in the report describe scenarios where consumers are commonly forced to become party litigants after the Law Society intervene in the claims process, forcing claimants legal representatives to withdraw from acting in financial damages claims against against other solicitors.

The Research Report sourced comments from claimants: “I keep fighting cases, and they keep coming at me, and now I have become ill. But they still keep coming at me. They threw me out onto the street, I couldn’t get my medication, I’ve got nothing, I was homeless, ill, sleeping in the car. Now I am appealing. But I can’t get a solicitor. They are just shutting me down…. My health has been damaged, they kill you off. It’s a proven fact. All of us have stress related problems after years and years of stress.”

The Research Report sourced comments from claimants: “I keep fighting cases, and they keep coming at me, and now I have become ill. But they still keep coming at me. They threw me out onto the street, I couldn’t get my medication, I’ve got nothing, I was homeless, ill, sleeping in the car. Now I am appealing. But I can’t get a solicitor. They are just shutting me down…. My health has been damaged, they kill you off. It’s a proven fact. All of us have stress related problems after years and years of stress.”

The report also linked the Law Society’s insurance scheme to suicides of clients who attempted to claim back funds appropriated by corrupt solicitors.

The report stated: “Several claimants said that they had been diagnosed with depression; that they had high blood pressure; and several had their marriages fail due to their claim. Some had lost a lot of money, their homes, and we were told that one party litigant had committed suicide.”

The report concluded: “What has clearly come through these interviews has been the very divergent views of solicitors and claimants/consumer groups as to the primary function of the Master Policy. The former tend to see it as simply a professional negligence insurance designed to protect individual members of the profession. The latter see that its primary purpose should be to protect the public against incompetent members of the profession. Whilst these are not incompatible aims we have come to the view that the rhetoric of the Law Society of Scotland encourages the latter perception but practice is more inclined to the former. In other jurisdictions there is a more explicit statement that it is the former.”

“It is clear that establishing a valid claim under the Master Policy requires either an admission of liability on the part of the solicitor or an action to be taken by the claimant to establish liability. It is our view that the Law Society of Scotland raises the expectations of potential claimants by emphasising the Master Policy’s public protection role. It is perhaps more accurate to say that policy ensures that those with a proven claim will be able to recover.”

“Those claimants to whom we spoke were very much of the opinion that it was difficult to establish liability of a solicitor for professional negligence. It would be desirable to test this claim by looking at the record of the Master Policy in terms of claims and compensation paid. Data which would have allowed us to do this was requested from the Law Society of Scotland but was only made available the day before this Report was due to be submitted. Furthermore the Law Society of Scotland and Marsh put conditions on the use of the data in this Report which were unacceptable to us and to the Chief Executive of SLCC.”

“The limited data which we have seen on the Guarantee Fund suggests that there is a considerable difference between the value of claims and the sums paid out by the Fund. We have not been able to establish whether this is a result of the discretionary nature of the fund or simply a large divergence between parties in assessing the sums lost.”

“We would recommend that the Scottish Legal Complaints Commission undertake a longer term research project which will allow researchers to examine the experiences of a representative sample of claimants and solicitors as well as analyse data on claims provided by the Master Policy’s broker under reasonable conditions of use.”

Dr Angela Melville – who interviewed many clients for her final report, confirmed the research team did not receive a copy of the Master Policy itself after Marsh director Alistair J Sim, demanded strict conditions for the disclosure of the insurance policy’s terms.

Sim wrote in a letter to the University research team – which appears in full on the last page of the report: “Please note that the consent of Marsh and Royal & Sun Alliance plc to the production of the enclosed documents is condition on the research team agreeing not to quote from the documents, or any part of them, whether text or figures, in the report to the Scottish Legal Complaints Commission.”

Sim’s letter continued: “The documents which are produced are confidential and are commercially sensitive. They are provided to the research team only and neither the documents nor copies should be provided to any other party nor should the content of the documents be disclosed to anyone outside the research team. At the conclusion of the research project, the documents should be returned with confirmation that foregoing conditions have been complied with and that no copies have been retained. If the research team is unable to agree to the foregoing conditions, the documents should be returned along with confirmation that no copies have been retained.”

No further research has been commissioned by the Scottish Legal Complaints Commission since the report was published in 2009, and with the SLCC now under substantive control of the Law Society of Scotland, much of what it produces by way of research and statistics is widely recognised as having little honest value in terms of consumer protection.

The Master Policy started in November 1978 under brokers Sedgwick Forbes UK Limited, which later became part of the Marsh Group. Given the highly specialist nature of professional indemnity insurance, the brokers play a vital role in arranging and securing the insurance cover as well as providing administration, advice, as well as risk management training.

Along the years, law firms acting for the Master Policy included Simpson & Marwick – now merged with Clyde & Co, Balfour & Manson and other ‘big name’ law firms brought in to demolish consumers attempts to reclaim millions of pounds lost, misappropriated or embezzled by Scottish solicitors.

While the Master Policy is tasked with dealing with claims for negligence, the Law Society has been known to manipulate claims on a serial basis. Unsurprisingly, even claims which do succeed against the Master Policy bear little return to clients who are forced to go through lengthy court processes in front of a judiciary who have also previously paid into the same Master Policy arrangement while serving as solicitors in their earlier years prior to the bench.

You must be logged in to post a comment.